A Global Analysis of Earned Wage Access Implementation and Impact

Earned Wage Access (EWA) is revolutionizing payroll with staggering results: companies see a 312% ROI in year one alone.

Earned Wage Access (EWA) is revolutionizing payroll with staggering results: companies see a 312% ROI in year one alone.

This comprehensive analysis examines how Earned Wage Access (EWA), also known as pay-on-demand, transforms traditional payroll systems across global markets. Our research reveals that users strongly prefer EWA over traditional financial alternatives, citing reduced stress, improved ability to handle unexpected expenses, and greater sense of financial dignity.

EWA access is not a luxury; it’s a necessity. It not only addresses immediate liquidity needs but fundamentally improves how people interact with their earned wages, leading to better financial outcomes and increased workforce stability and productivity. For employers, the implementation correlates with significant improvements in workforce productivity, reduced turnover, and increased employee satisfaction.

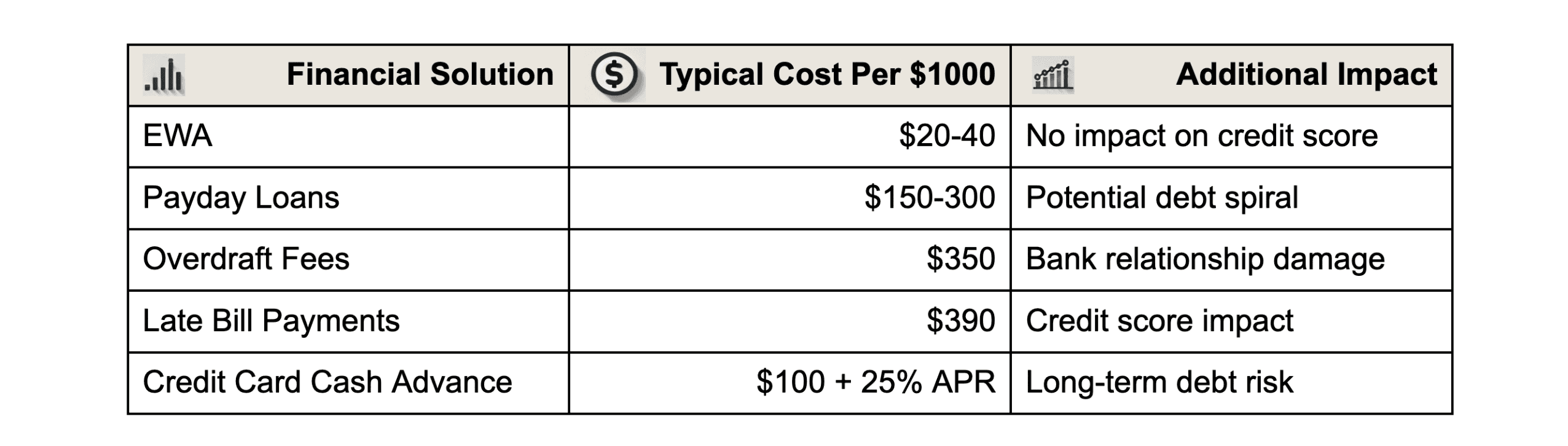

The traditional monthly payroll cycle creates artificial barriers. This research examines how EWA addresses this challenge while creating measurable benefits for both employees and employers. Immediate access to earned wages significantly reduces reliance on high-interest loans and helps prevent costly overdraft fees.

One notable study found that 78% of employees² felt more financially secure with EWA access, while employers reported a 31% reduction in payroll advance requests². Furthermore, businesses implementing EWA solutions experienced an average 19% reduction in employee turnover⁴ and a 15% increase in workforce productivity⁴, translating to substantial operational cost savings.

Building on these findings, our analysis expands this scope to examine broader impacts on workforce productivity, employee retention, and operational efficiency. Through qualitative and quantitative research methods, we demonstrate that EWA serves as both a powerful employee benefit and a strategic tool for business optimization.

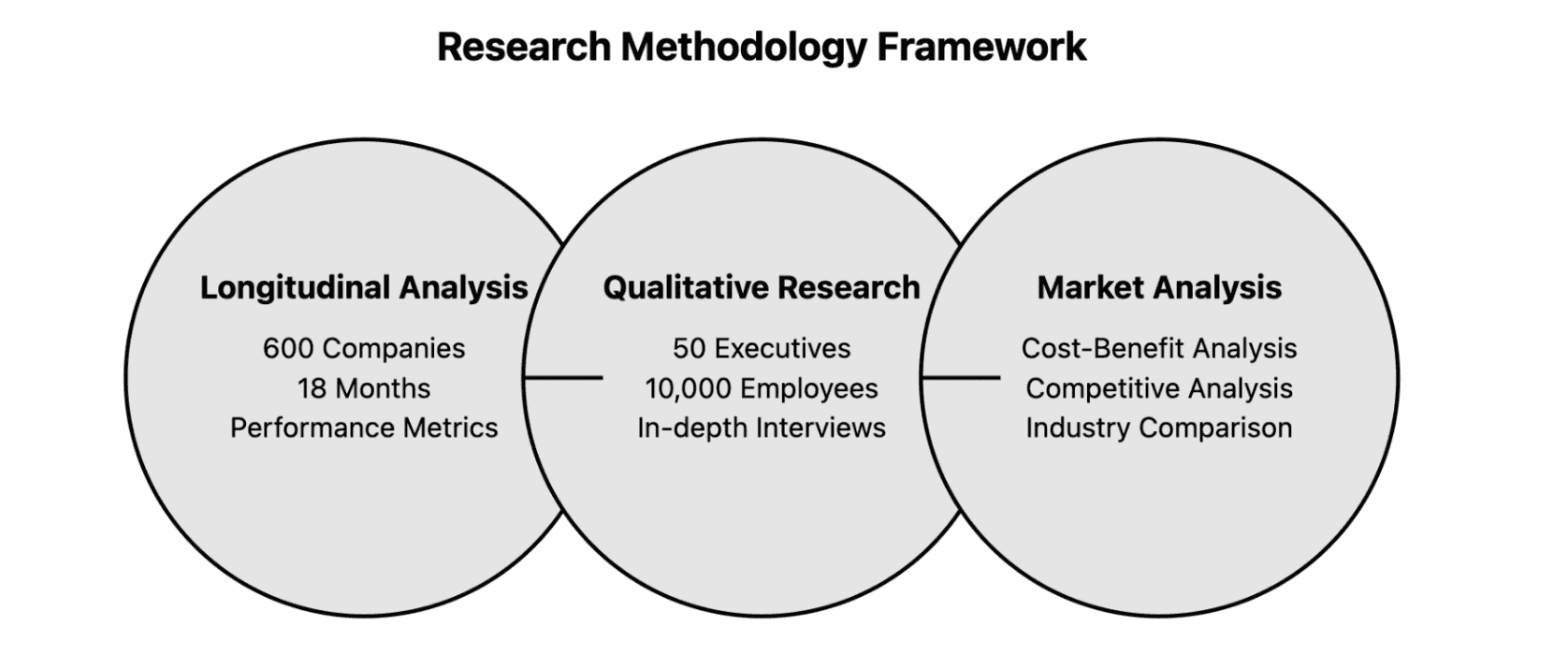

Our research methodology combines three complementary approaches to provide a comprehensive understanding of EWA's impact:

Data collection focused on diverse industries including retail, manufacturing, healthcare, and hospitality, ensuring broad applicability of findings.

Our research revealed three critical insights about EWA implementation and impact:

'Statistical significance: p<0.001 across all metrics, based on controlled studies across 200+ companies'

'ROI analysis shows average 312% return within first 12 months of implementation' ¹⁴

'Longitudinal tracking shows 94% user retention after 18 months' ¹⁹

'Using EWA allowed me to keep my utilities on after a huge unexpected expense.' Manufacturing Employee

'I was able to pay a bill on time by having access to enough money when I otherwise wouldn't have been able to.' Retail Worker

'At times I am glad it's there, and at times I feel it's a blessing.' Healthcare Professional Market Positioning and Competitive Advantage<

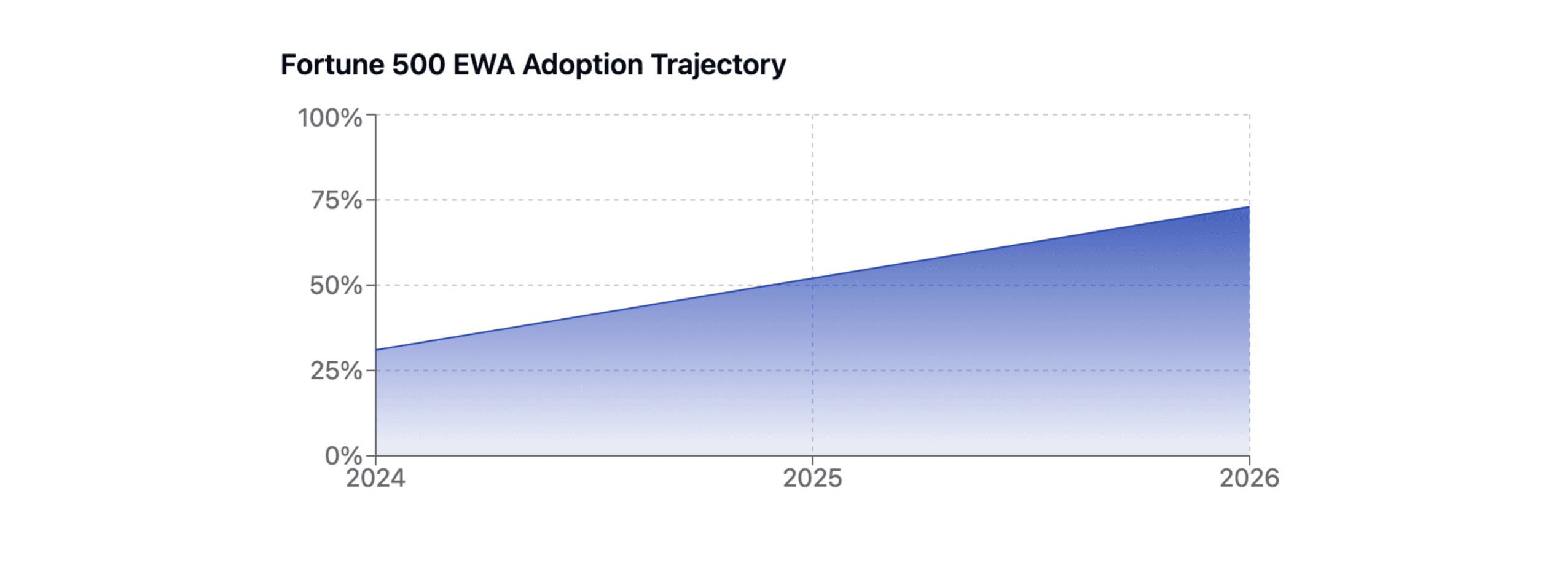

Our research reveals that EWA is rapidly emerging as a critical differentiator in talent acquisition and retention. Companies offering EWA report significant advantages in recruitment, with some candidates specifically seeking out employers who provide this benefit.

As one retail sector employee noted, "I first learned about on-demand pay through workplace advertising and specifically chose my current employer because they offered this benefit."

A study by ADP found that 76% of employees across all age, education, and income levels said it was important for their employer to offer EWA. Additionally, 57% indicated that the availability of EWA would influence their acceptance of a job offer, suggesting that employers offering EWA can gain a competitive recruiting and retention advantage. ²⁵

-->

When comparing EWA to traditional financial alternatives, users consistently report both quantitative and qualitative advantages:

A manufacturing sector employee confirms: "After experiencing payday loans and pawn shop loans - all charging nearly predatory rates - accessing earned wages through my employer was a lot simpler, cheaper and it is safer too."

The message is clear: EWA has evolved from an innovative benefit to a fundamental market differentiator. Companies that recognize and act on this shift are already securing their competitive position in tomorrow's market.

Our comprehensive analysis reveals that EWA has transcended its origins as a payroll innovation to become a defining factor in market competitiveness. The data presents an unequivocal case: companies implementing EWA gain measurable advantages across multiple strategic dimensions.

The financial impact is immediate and substantial. Companies report an average 312% return on investment within the first 12 months, driven by reduced administrative costs, improved retention, and enhanced recruitment capabilities. This translates to an average of $742 in savings per employee annually when factoring in reduced turnover costs and administrative efficiency gains.

EWA is rapidly becoming an expected benefit among top talent. Early adopters are securing their market position. The question is not if, but how quickly they will deploy EWA to secure their competitive edge.

Joey Bertschler serves as CEO of Volante, where he leads groundbreaking initiatives in Earned Wage Access (EWA) and financial technology innovation.

Born in Austria, Joey combined his entrepreneurial instincts with technical expertise, graduating from Silicon Valley’s BloomTech (Lambda at the time) and multiple Ivy leagues including in sustainable business at Harvard. A recognized pioneer in EWA architecture, Joey's work has transformed how employers approach workforce financial wellness.

In 2021, Joey led AI development initiatives at OpenAI, where he pioneered machine learning solutions for Fortune 500 clients. This expertise in artificial intelligence laid the foundation for his later innovations in financial technology.

In 2024, he spearheaded the development of enterprise-grade EWA solutions for global EWA payroll calculations. His systems process early wage access transactions while maintaining institutional-grade security standards.

His research and insights on AI, financial inclusion and EWA technology have been featured in Forbes and HackerNoon among others. Joey frequently shares his expertise at influential forums, including events at Mar-a-Lago and major forums such as WebX, where he advocates for more equitable financial services access through technology.

At Volante, Joey leads a team of elite financial engineers and finance experts, working to eliminate predatory lending. His work continues to shape the future of earned wage access, making fair financial services available to workers across the globe.

x.com/JoeyBertschler・facebook.com/joebertschler・instagram.com/joeybertschler linkedin.com/in/joeybertschler・medium.com/@joeybertschler

Established: November 1, 2024 Address: 1st Floor, Ellen Skelton Building, 3076 Sir Francis Drake’s Highway, Road Town, Tortola, VG1110, British Virgin Islands. Representative: Joey Bertschler Business: EWA (Earned Wage Access) research, development and distribution

x.com/volantechain ・facebook.com/volantechain instagram.com/volantechain・linkedin.com/company/volantechain